Renters Insurance in and around Ithaca

Get renters insurance in Ithaca

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Ithaca

- Finger Lakes Region

- Tompkins County

- Cayuga County

- Cayuga Heights

- Lansing

- Trumansburg

- King Ferry

- Dryden

- Freeville

- Watkins Glen

- Groton

- Cortland

- Candor

- Aurora

- Spencer

- Genoa

- Moravia

- Montour Falls

- Odessa

- Newfield

- Homer

- Van Etten

- Richford

Home Is Where Your Heart Is

There's a lot to think about when it comes to renting a home - furnishings, outdoor living space, price, house or apartment? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Ithaca

Your belongings say p-lease and thank you to renters insurance

There's No Place Like Home

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects the things inside the place you call home with coverage. If your rental is affected by abrupt water damage or vandalism, some of your most treasured items might have damage. If you don't have enough coverage, you might not be able to replace your valuables. It's scary to think that in one moment, you could lose it all. Despite all that could go wrong, State Farm Agent Zach Clark is ready to help.Zach Clark can help offer options for the level of coverage you have in mind. You can even include protection for valuables beyond the walls of your home. For example, if your bicycle is stolen from work, your car is stolen with your computer inside it or your personal property is damaged by a fire, Agent Zach Clark can be there to help you submit your claim and help your life go right again.

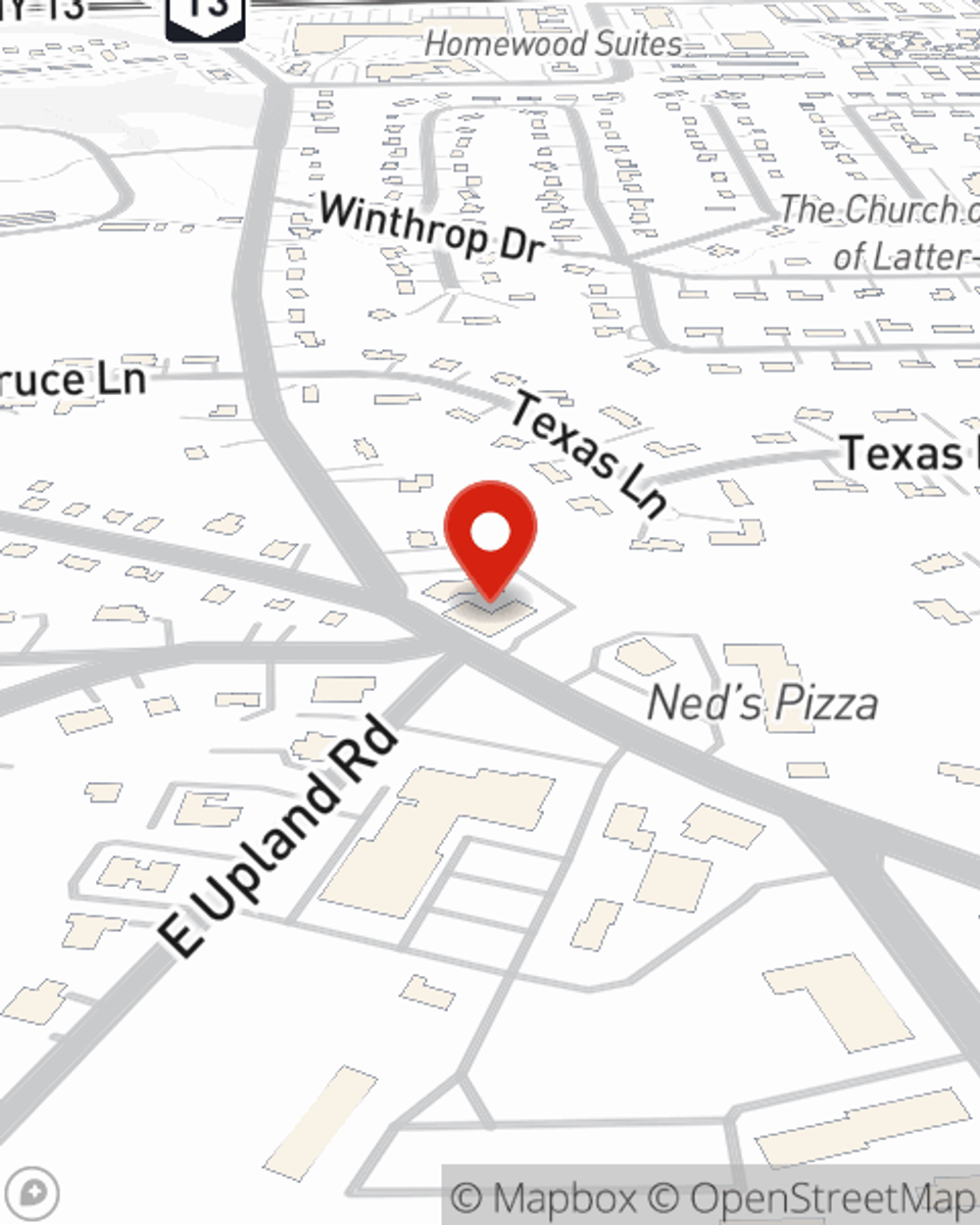

Contact State Farm Agent Zach Clark today to see how the leading provider of renters insurance can protect your possessions here in Ithaca, NY.

Have More Questions About Renters Insurance?

Call Zach at (607) 257-8900 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.